Recent data from U.S. Customs and Border Protection indicates that between October 2020 and August 2024, over 86,400 Indian nationals were intercepted while attempting unauthorized crossings at the U.S. southwest border. During the same period, more than 88,800 Indian...

Recent data from U.S. Customs and Border Protection indicates that between October 2020 and August 2024, over 86,400 Indian nationals were intercepted while attempting unauthorized crossings at the U.S. southwest border. During the same period, more than 88,800 Indian...

Have your credit cards been maxed out to their limits? Do you pay only the minimum amount due or less on any of your credit cards each month? Here is an infographic that explores these and other credit related questions which will help one to determine if they need to...

Have your credit cards been maxed out to their limits? Do you pay only the minimum amount due or less on any of your credit cards each month? Here is an infographic that explores these and other credit related questions which will help one to determine if they need to...

Bankruptcy laws have changed drastically throughout the course of history in both the United States and abroad. You might be surprised to discover that insolvency and bankruptcy far predate the woes of today’s U.S. citizens. In the following infographic, learn...

Bankruptcy laws have changed drastically throughout the course of history in both the United States and abroad. You might be surprised to discover that insolvency and bankruptcy far predate the woes of today’s U.S. citizens. In the following infographic, learn...

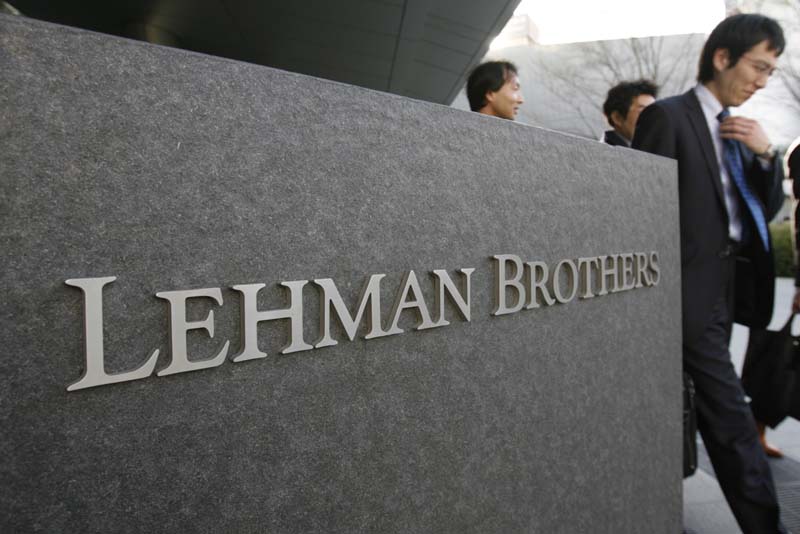

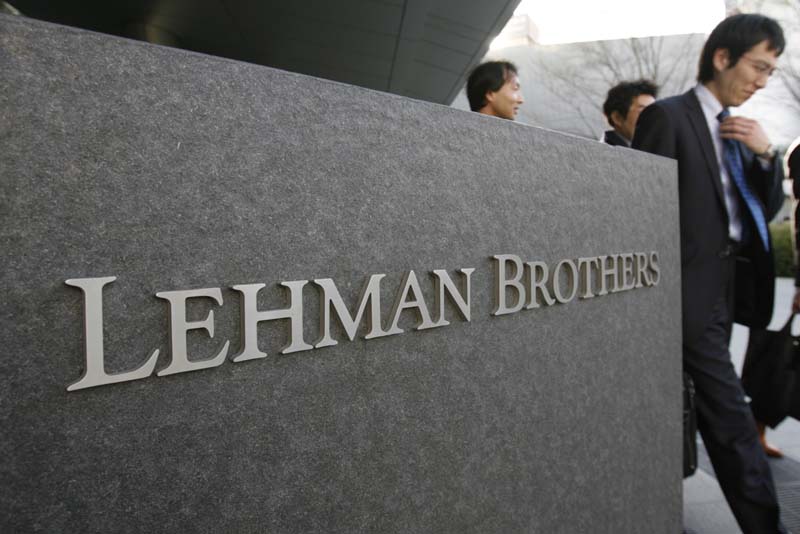

Before they filed for bankruptcy, Lehman Brothers Holdings Inc. was the fourth-largest investment back in the United States. Unfortunately, due to their involvement in mortgage origination, the company plummeted hard during the mortgage crisis of 2008. Here is an...

Before they filed for bankruptcy, Lehman Brothers Holdings Inc. was the fourth-largest investment back in the United States. Unfortunately, due to their involvement in mortgage origination, the company plummeted hard during the mortgage crisis of 2008. Here is an...

Lien stripping and lien avoidance are useful tools used in bankruptcy when a creditor has put a lien on your house or some other tangible property. Lien stripping is available in any of the reorganization chapters such as Chapters 13, 11 and 12 but is not available in...

Lien stripping and lien avoidance are useful tools used in bankruptcy when a creditor has put a lien on your house or some other tangible property. Lien stripping is available in any of the reorganization chapters such as Chapters 13, 11 and 12 but is not available in...

According to Studentaid.ed.gov, the total outstanding debt on student loans as of 2018 was $1.6 trillion!!! This does not consider private student loan. About $92.02 billion of these student loans are more than 90 days late. There are many types of student loans. The...

According to Studentaid.ed.gov, the total outstanding debt on student loans as of 2018 was $1.6 trillion!!! This does not consider private student loan. About $92.02 billion of these student loans are more than 90 days late. There are many types of student loans. The...

Translate Language »